This post is also available in: 日本語

Introduction

The number of freelancers is rapidly increasing due to the acceleration of various working styles, including the reform of working styles and the lifting of the ban on part-time work. In North America, it’s even predicted that 50% of freelancers will be freelancers by 2020 (Lancers). At the same time, financing is a critical issue for freelancers. For example, it’s best to have a short time between sending an invoice and depositing money.

What Is Factoring?

Factoring services are financing services that dramatically reduce the time it takes to receive cash by purchasing invoices (= Accounts receivable). Since factoring services are a purchase of receivables, they have the advantage of speeding up procurement because they are not loans (= Debts). See the following articles for a general description of factoring services and a comparison of key services.

Compare the factoring services available for freelancers! Speed, reliability, and fees?

What Is OLTA?

OLTA is a cloud factoring service provided by OLTA Inc.

What kind of company is OLTA Inc?

OLTA Corporation is a startup founded in 2017. However, in June 2.5 billion, we successfully raised 2019 yen in capital from major financial institutions such as MUTB, SMBC, and Mizuho Bank. As a result, we are expanding our business very smoothly.

Application amount exceeded 10 billion yen “Cloud Factoring”. OLTA raised 2.5 billion yen.

What is OLTA as a cloud factoring?

Now let me introduce the OLTA service. OLTA is a cloud factoring service. It comes with cloud and makurakotoba, but all features are the completion of factoring services online.

Who can use OLTA?

OLTA services are available for both individuals and corporations.

What is the purchase price?

One of the characteristics of OLTA is that there is no upper or lower limit on the amount of money to buy bills. In other words, you can use from small amount. AI review within 24 hours. OLTA reviews are performed by AI, not by human, and the review time is less than 24 hours. One of OLTA’s strengths is that its own AI scoring system enables quick and reasonable appraisal.

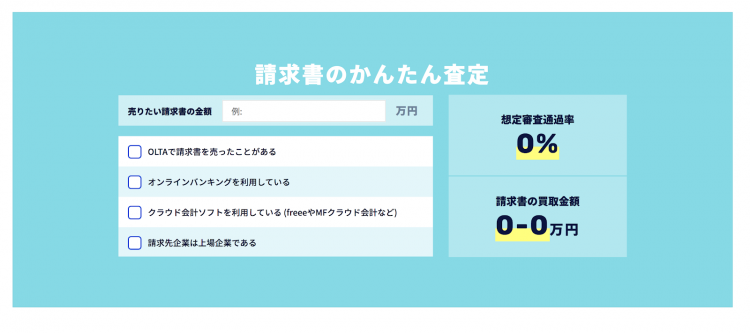

Simple assessment with simulation

On the OLTA home page, you can simulate the pass rate and purchase price by simply entering information.

Unique preferential treatment system

OLTA has its own class based on usage. At first, it starts from economy class, and eventually it will be upgraded to first class. Details have not yet been made public, but it is assumed that fees and other conditions will be favored.

How To Use OLTA?

There are three steps to using OLTA:

- Offer

- Examination

- Receipts

offer

For OLTA service applications, we will submit the following four documents online.

Identification documents of the representative

- invoices to be sold

- statement of deposits and withdrawals for the last seven months

- last year’s financial statements

examination

As mentioned above, the AI process takes place within 24 hours.

Receipts

After passing the examination, the money will be deposited to the registered bank account on the same day.

Summary

As you can see, there is a cloud factoring service as a means of raising funds for private business owners (= Freelance) and small and medium enterprises. As for OLTA, with a reliable shareholder structure and a clean and stylish UI, factoring options are more accessible. If you have any cash flow issues, please consider them.

UTILLY also introduces a similar factoring service called FREENANCE, which is operated by a subsidiary of GMO. Please refer to the following article if you like.